See the full presentation in PDF

August 2022

2nd Argentina Energy Summit 2022

Neuquen Basin vs Permian Basin, and the winner is …

Lucas Santimoteo, Plata Energy

Presentation highlights

- Key technical similarities and differences at basin level and current unconventional producing units

- Historical pace of development and so far achievements

- Potential size of the remaining price

- Argentina’s challenges

- Closing Remarks

Key technical similarities and differences at basin level

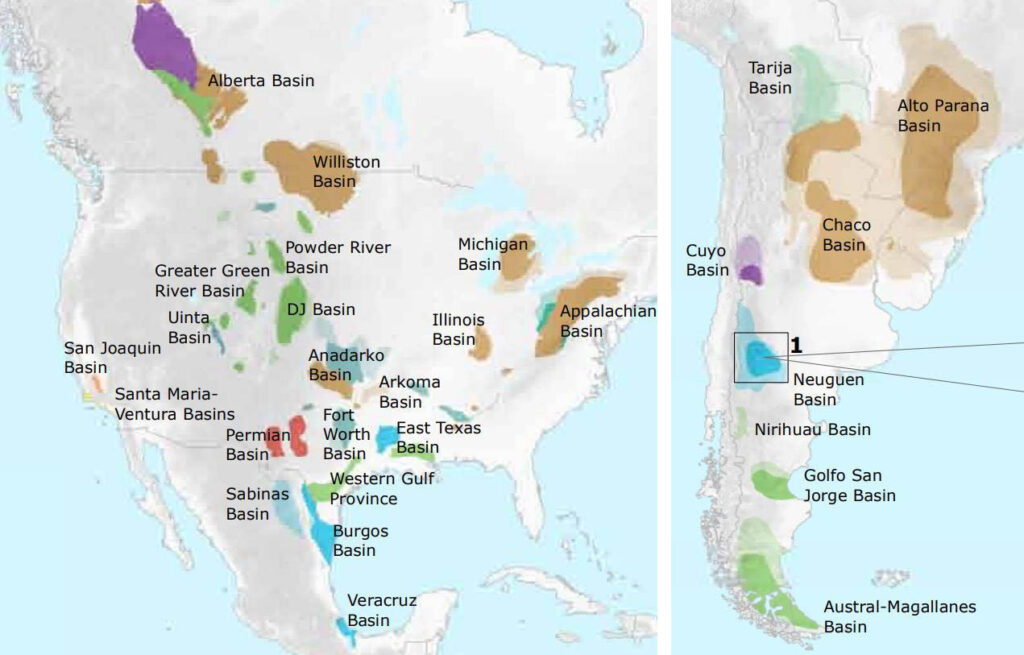

Areal distribution and location

Source: Boundaries of the Permian Basin extent and Permian sub basins are from US Energy Information Administration (2017)

- Permian basin 27.000 square miles (65.000 sq km)

- Neuquen basin 11.600 square miles (30.000 sq km)

- Neuquen <50% of Permian acreage

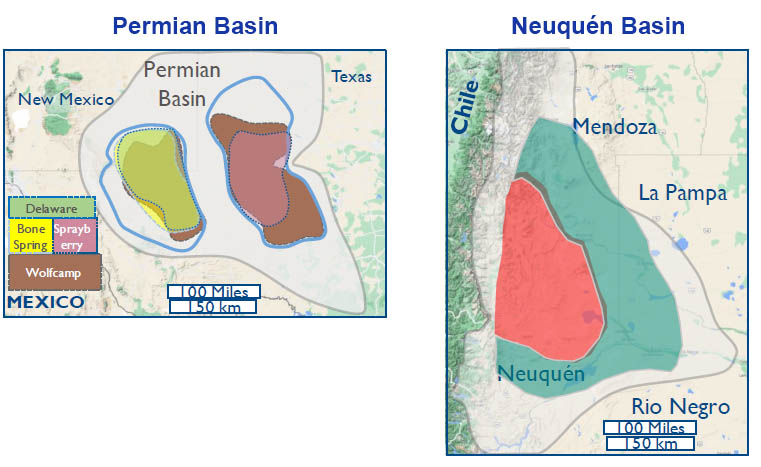

Key technical similarities and differences

Key technical similarities and differences at basin level

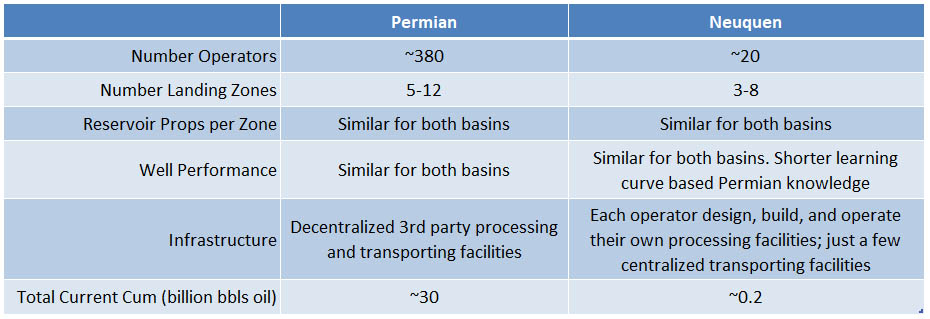

Stratigraphy and Producing Units

Similar rock quality; VM with less thickness

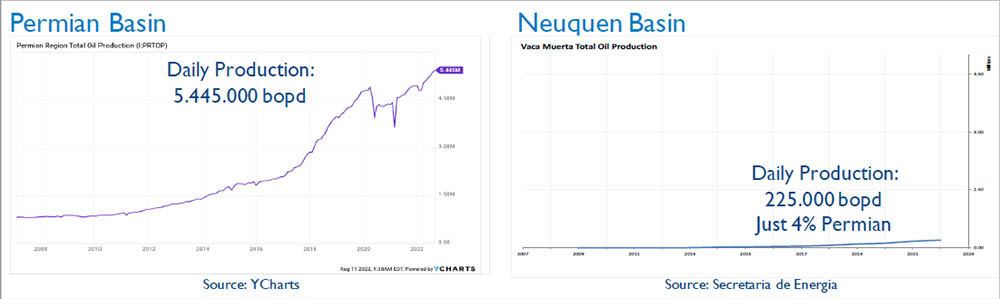

Historical development pace and achievements

- The Permian basin has a total number of unconventional wells of about 45.000 wells (~80% of them are horizontal) and the current active drilling rigs are around 350

- Neuquen basin with only 1.250 unconventional wells (~60% horizontal) and around 40 active drilling rigs

- Total current cum: ~30.0 billions bbls oil vs Neuquen ~0.2 billions bbls oil (0.6% over Permian)

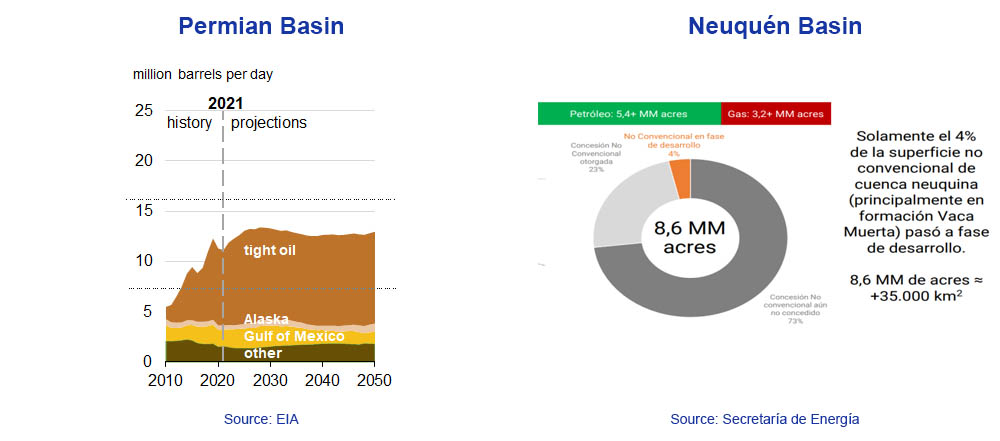

Potential size of the remaining price

Recoverable reserves:

- Permian basin are about 105 billion barrels (~30% of it already produced)

- Neuquen basin 16 billion barrels (only ~1% of it already produced)

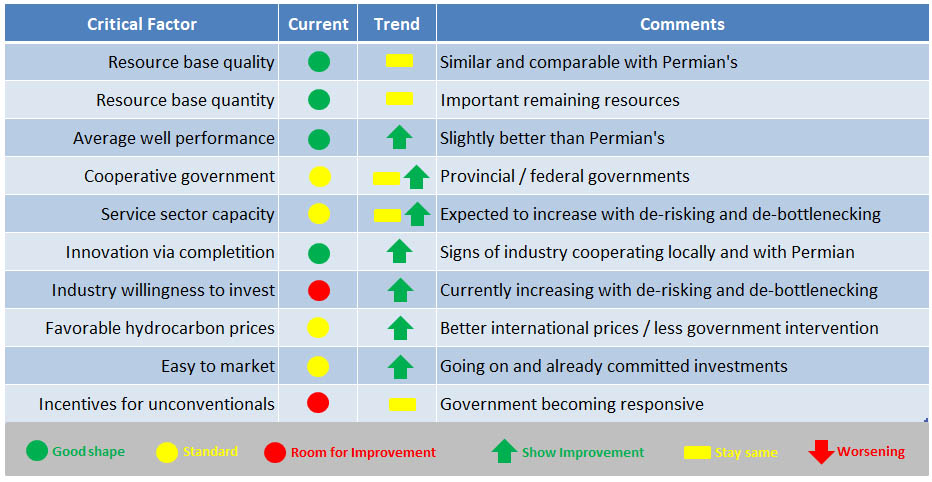

Challenges in Argentina to replicate US

Closing remarks

Neuquen Basin vs Permian, and the winner is …

- Both basins have excellent business cases and demonstrated important remaining resources

- Both basins benefit from sharing same operators / services companies with common lesson learned and best practices

- Sharing developing and implementing creative tools in drilling and completion create costs and time reductions in both basins

- Proved high performance and efficiency in companies organized as factory model approach

- Vaca Muerta has half of the acreage but only 4% has been drilled and 1% of cum production

- But as in every match, there are other factors Argentina need to improve:

- Access to market, both from equipment, tools, and materials, as well as customers

- Local infrastructure might act as a massive development bottleneck

- Administration incentives to producers and develop proper stable regulations for shale

US Permian is the business model to be followed if Vaca Muerta is to be successful since both have similar developing dynamics and rock quality

See the full presentation in PDF