See the full presentation in PDF

Revitalizing Mature and Marginal E&P in a Lower Price Environment

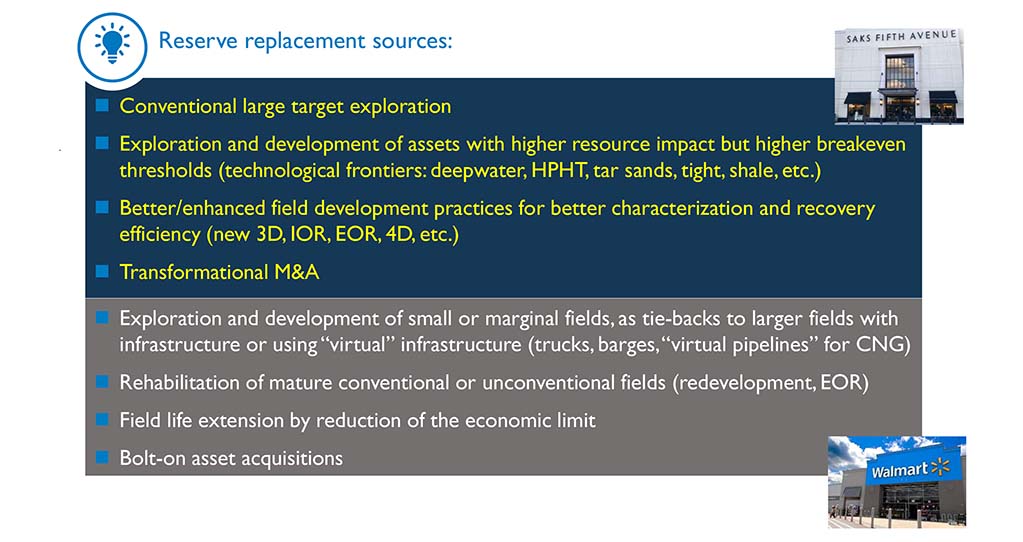

Not all sources of reserves are glamorous

There is considerable potential left in “marginal”

What is “marginal”?

Opportunities that under current conditions appear sub-economical, for various reasons:

- Perception of “low materiality” (by definition, relative to the observer’s point of view and its internal corporate financial

hurdles) - Higher asset age and degree of depletion

- Lack of attention from the Operator due to low relative importance vis-à-vis the “core” assets in its portfolio

- Located in environmentally/socially sensitive areas, or with poor public safety

- Stranded in remote areas without adequate evacuation infrastructure or no immediate/clear monetization schemes

- Typically have reserves/resources accounted for as Probable, Possible, Contingent, Technical or Prospective, which will not

be timely migrated to Proven Reserves and transformed into Production

The low-hanging fruit

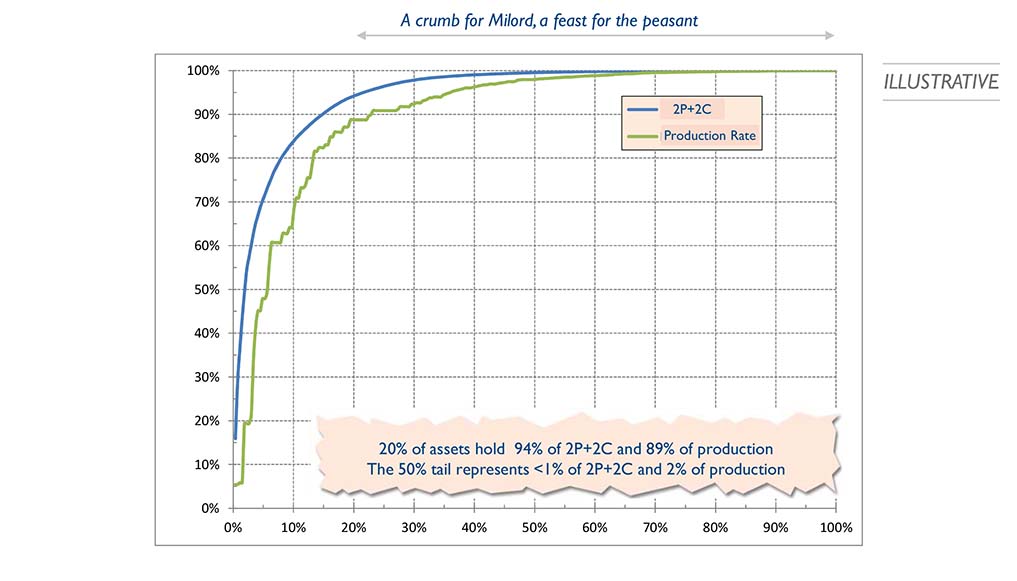

Statistically and geologically, there are ample conventional resources to be discovered and recovered from smaller, mature or “economically marginal” assets

If their shortcomings can be somehow addressed, they may offer the following advantages:

- Conventional technologies and equipment (off-the-shelf)

- Lower costs -> lower breakeven prices

- Lower geological and extraction risks

- Short-term response. May fill-in gaps while major projects come online

- Natural to the experience and capabilities of small and medium independent OilCos

- Good for incubating local independent startups

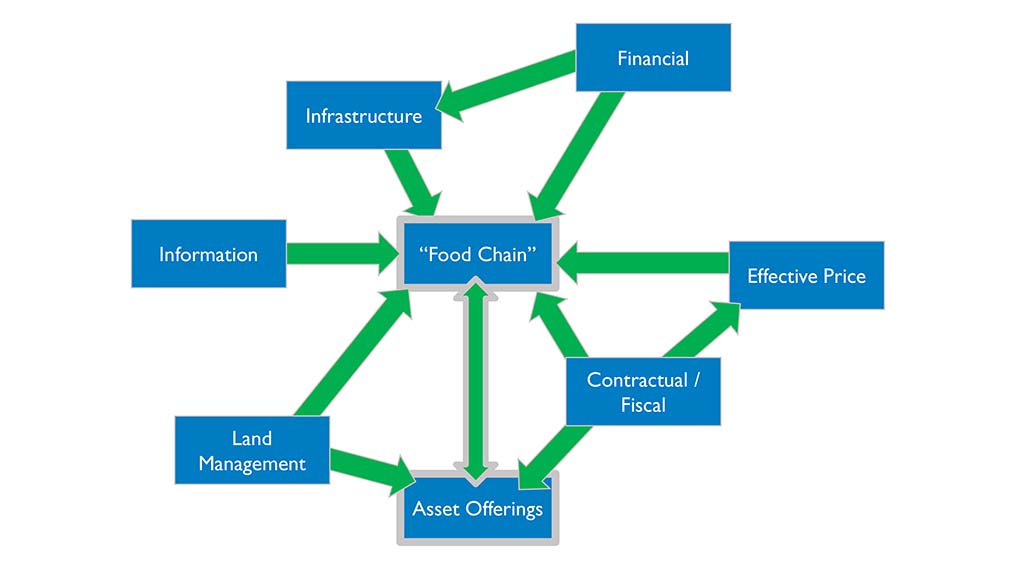

Is there a Control Panel?

The Government has at its reach some levers that can influence the economic equation of an asset, and nudge it positively

- Obviously, the economic equation is dominated by variables outside of the Government’s control: scale of the resource, productive behavior, price of HCs, physical finding, development and lifting costs

- However, there are some levers it can actuate:

How do you stimulate “marginal”?

Governments have multiple levers potentially at their disposal:

- INFORMATION

- Make it widely and cheaply available

- “FOOD CHAIN”

- Promote the participation of many smaller actors in the local HC market. Facilitate agile A&D transactions

- ASSET OFFERINGS

- Hold “marginal” field tenders, discriminating the quantitative prequalification criteria to suit the target audience, properly designing the bid variables and their relative weights

- INFRAESTRUCTURE

- Alleviate infrastructure bottlenecks. Stimulate or invest in midstream to help monetization, stimulate local thermal generation

- EFFECTIVE PRICE

- Revert negative price interventions or subsidize domestic prices. Personally, I prefer to let market prices be, come rain or sunshine

- LAND MANAGEMENT

- While respecting contract sanctity, incentivize dominant incumbents to sell, farmout or contract (e.g., incremental production) assets for which they don’t have specific investment plans

- CONTRACTUAL / FISCAL

- Adequate contractual models for marginal assets (licenses or PSCs)

- General or discretional reductions in government take (royalty or tax holidays)

- Provide fungible tax credits

- FINANCIAL

- Promote/seed investment funds for micro-independents, acting as incubators

Many of these levers feedback and reinforce each other (virtuous cycle)

INFORMATION + FOOD CHAIN

An open platform with easy and cheap access is paramount to stimulating transactions

- Information should be public, after a reasonable period:

- Seismic and well logs

- Well production history

- Scout tickets / completion charts

- They allow any company to analyze and estimate the value of an asset independently, even before approaching the incumbent

- A first approach with a tentative number in hand, is much more effective

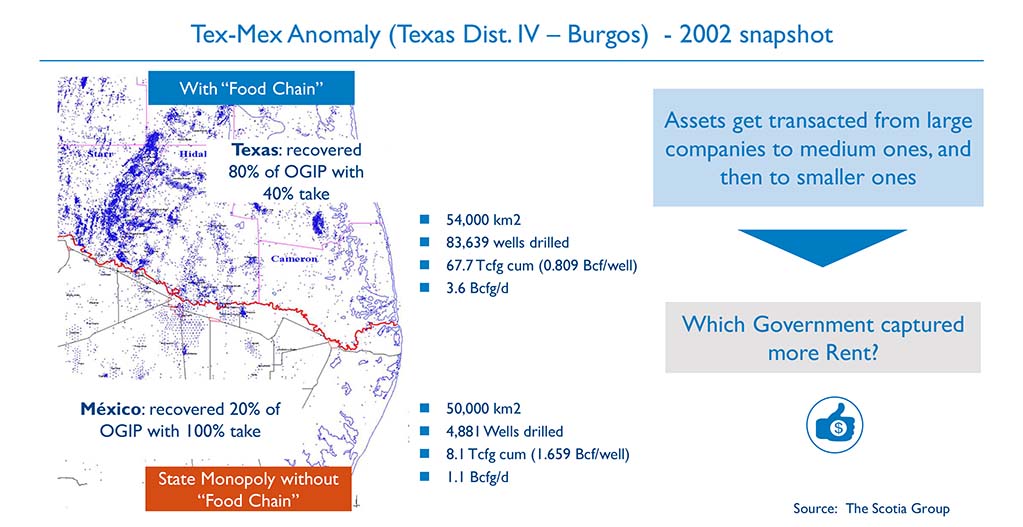

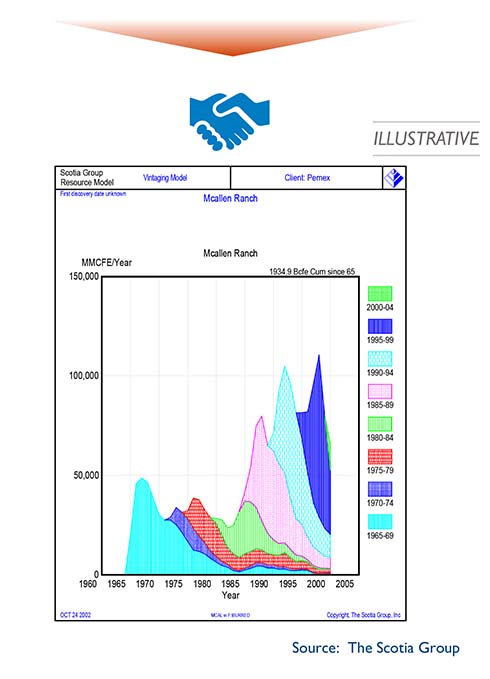

FOOD CHAIN

“Food Chain” –> A&D market –> much more drilling activity

An active A&D market increases drilling activity

- Reserve growth can yield results comparable to new exploration

- Change in ownership results in new drilling campaigns

- Risks and hurdles are lower

- Response is immediate

- Naturally, eventually the field will reach diminishing returns. Exploration continues to be essential

In this asset, seven successful drilling campaigns by seven different owners, before hitting the wall

FOOD CHAIN + LAND MANAGEMENT

A large/dominant company may want to rationalize its portfolio and do away with mature/marginal assets

CONTRACTUAL + FISCAL

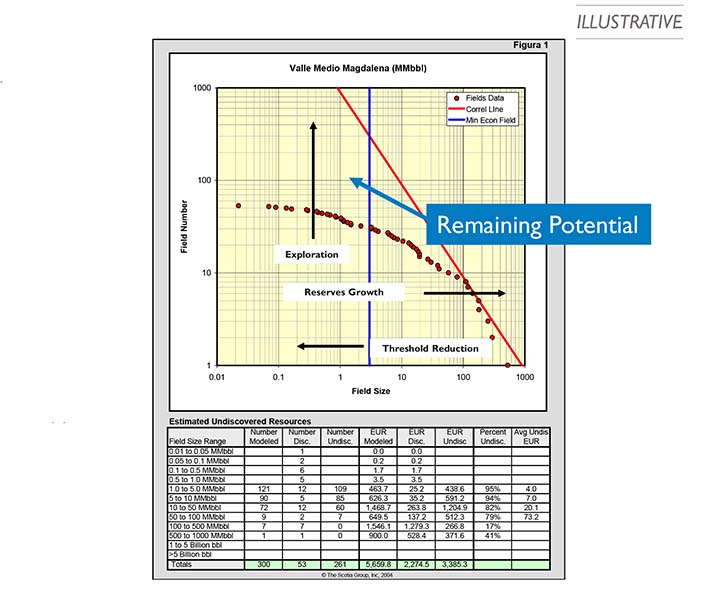

The Economic Field Size has a significant effect on basin reserves

- A basin’s remaining reserve potential depends on the field size economic threshold and the production economic limit

- The large fields are normally discovered first

- The implication is that if:

- (a) mature field lives are extended,

- (b) marginal prospects or fields are made commercial by better contractual and fiscal terms,

- and (c) micro-independents emerge and focus on discovering or revitalizing small fields,

- –> Mature basin reserves may grow again

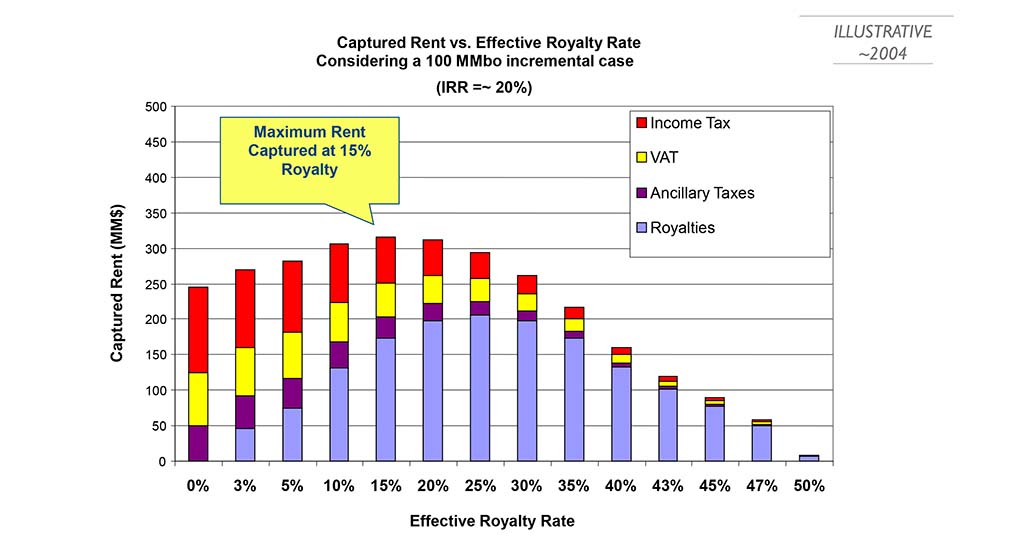

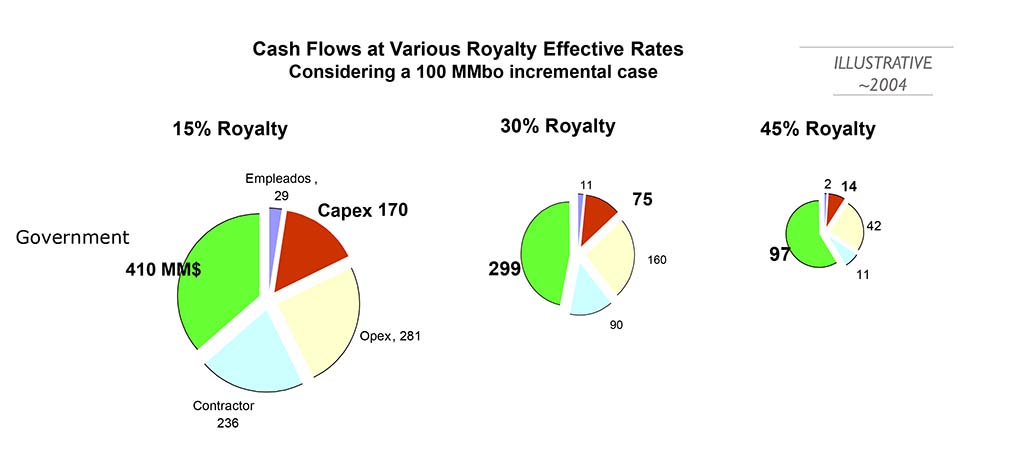

Higher Government Take does not imply higher Rent capture

CONTRACTUAL / FISCAL + ASSET OFFERINGS

Design for purpose the contractual terms and the tender mechanism

- Start with a Competitivity Study, comparing contractual, fiscal and regulatory frameworks with those of other countries competing for the same investments

- Design a contractual/fiscal system

- Adapted to the risk level

- Competitive

- Viable legally and politically. If it requires legislative change, it must be properly lobbied

- Present draft model to investors and be open to their feedback. To listen does not necessarily imply to acquiesce

- Design a Tender Process that:

- Attracts the right O&G investor population; those with the necessary and sufficient operational and financial capabilities for the project scale

- It must be transparent and simple (no more than two bid variables), which must be weighted so that the investment commitment dominates, not the hypothetical risk capture (“60% of something is much better than 90% of nothing”)

ASSET OFFERINGS

Maintain a steady rhythm of offerings to the right target audience

- Design bidding variables that incentivize Investment over Government Share or Take (e.g., relative weights 60/40)

- Investment commitments offer more flexibility than work commitments

- Maintain strict qualitative prequalification criteria, but relativize quantitative operational and financial criteria, adjusting them to the target audience (small independents and startups)

- CVs of senior management and operational staff, demonstrating industry and O&G asset operation experience

- Certificates of incorporation or formation, legal representatives and by-laws

- Comprehensive organization chart detailing the chain of control of each participating entity, down to natural persons

- Joint venture agreements, consortia, future partnership agreements, etc.

- No participant is in bankruptcy, from reorganization to liquidation

- Not allowing or having allowed its operations to be used as cover foe money laundering from criminal activities, including corruption, terrorism or tax evasion

- Commitment to establish a local branch, with a Legal Representative

- The Operator must hold at least 30% participation in the consortium

- Commitment guarantees supported by Letters of Credit

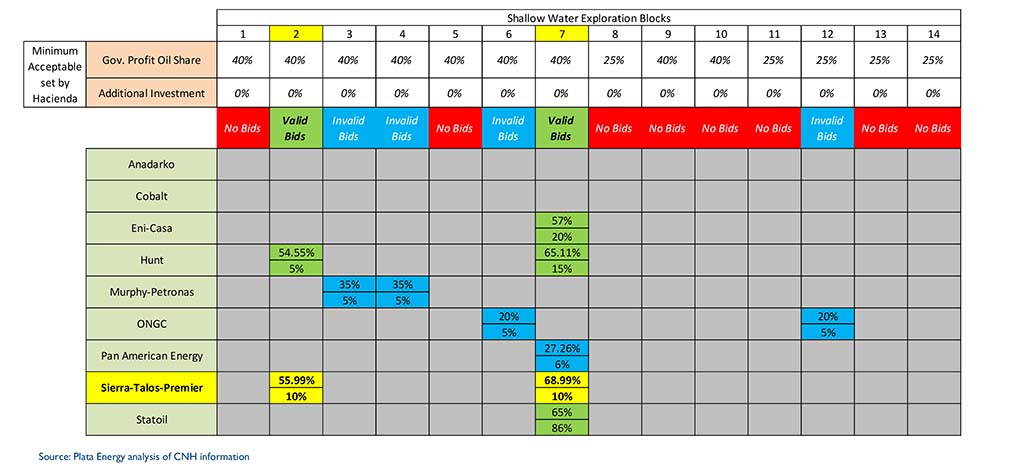

Bad example of bid round, rewarding gaming

- 90% weight to Government Share of Profit Oil, and 10% to Additional Investment

- In the hotly contested Block 7, Sierra et al, with a marginally higher profit Split beat a much larger exploration investment by Statoil (now Equinor)

CONTRACTUAL / FISCAL + FOOD CHAIN + FINANCIAL

Tax Credits in USA have been very effective in stimulating the “food chain” and A&D

USA fiscal incentives (historical)

- They lowered the economic field size threshold

- They were applied to anything “marginal” at the time: shales, Devonian gas, coal methane, tight gas, etc.

- A tax credit is much more powerful than a tax deduction

- In 2004, the credit was of $6.75/bo, and the phasing-our ceiling was in the $50.60-63.50/bo range for the average U.S. oil price. 2004 was the first year it got close to the ceiling

- A $6.75 tax rebate for every barrel sold could be credited or sold to a third party. They were fully fungible; transferable and applicable to any type of taxable income of any person. There

was even a market for them and their derivatives

FINANCIAL

If there is no international financing, or if local financing is too onerous for micro-independents, consider an incubator fund

Colombia (historical)

- Closed fund created in 2005

- Seed capital: $60 MM (42% by NOC Ecopetrol, 58% local private investors)

- A seasoned expert panel (geologist, geophysicist and engineer) evaluated proposals and provided advice on exploration strategy and process

- Portfolio balanced between low risk exploration (50-70%) and incremental production or field rehabilitation projects with quick monetization (30-50%)

- Fund participated as equity, convertible debt or mezzanine for stable cash flow. There was an exposure cap and a maximum 50% capital weight per project

- Establish credibility and then raise from international investors

Conclusions

In a lower price environment, there may be significant remaining potential in currently sub-commercial conventional prospects and fields with:

- Low geological or lifting risk

- Low technical complexity and moderate costs

- Often close to infrastructure, or to fields with evacuation pipelines, or amenable to trucking or barging

- Sort-term response

The Govt. has some tools or levers to pull to incentivize the harvest of the “low hanging fruit”, to supplement the response of the more material projects with higher complexity, costs, breakeven and lead times