See the full presentation in PDF

Global E&P Summit 2020

LatAm exploration investments: Why Latin America?

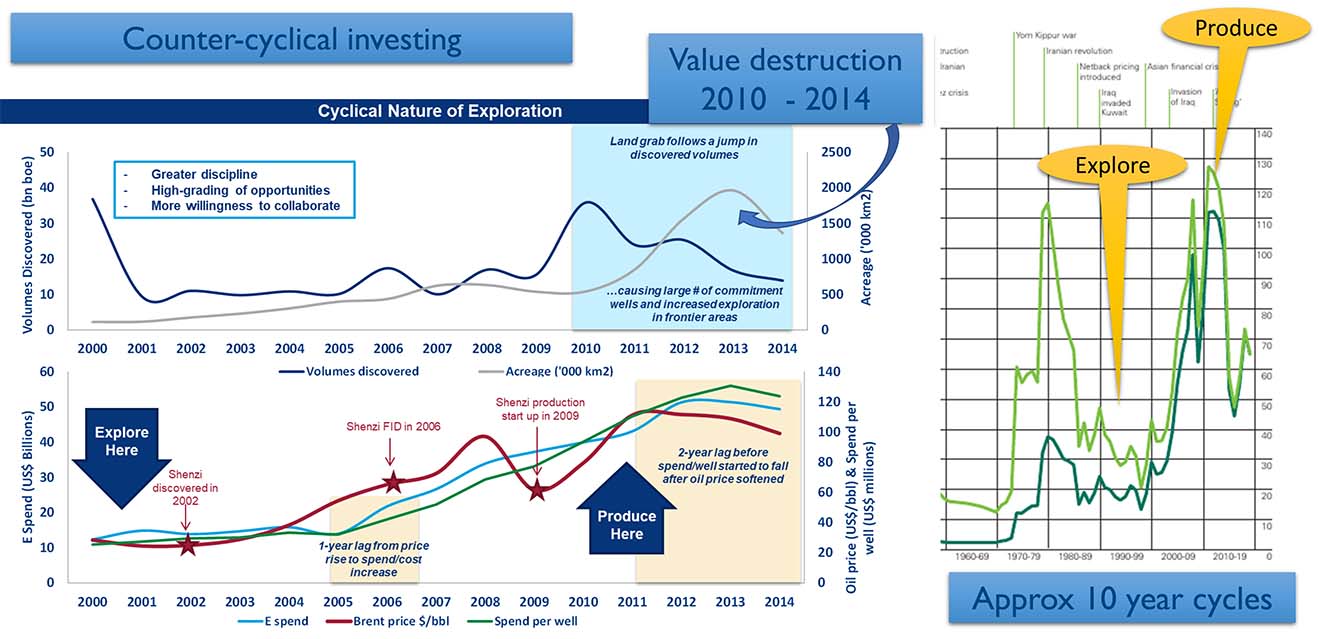

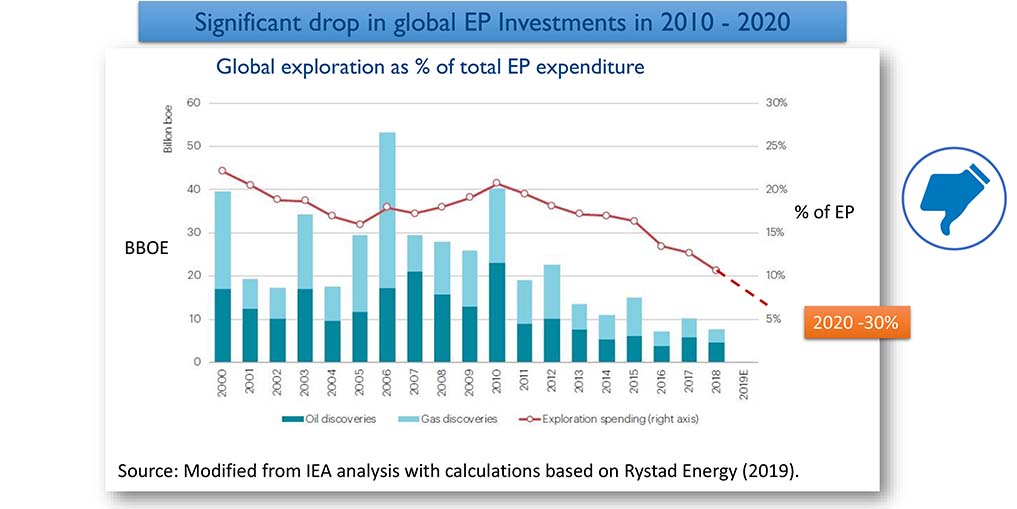

- Exploration investments and activity are coming to a worldwide historical low

- Investors should consider a counter cyclical positioning to harvest the benefits in the next high price cycle

- Latin America has distinctive benefits when considering building a position for the next cycle, compared to other regions

- Positives : Large resources, undeveloped markets and low breakeven prices

- Negatives: Political instability and high Government Takes

- Latin America could be transformed into a dominant player in the next cycle

LatAm exploration investments: Cyclical nature of E&P

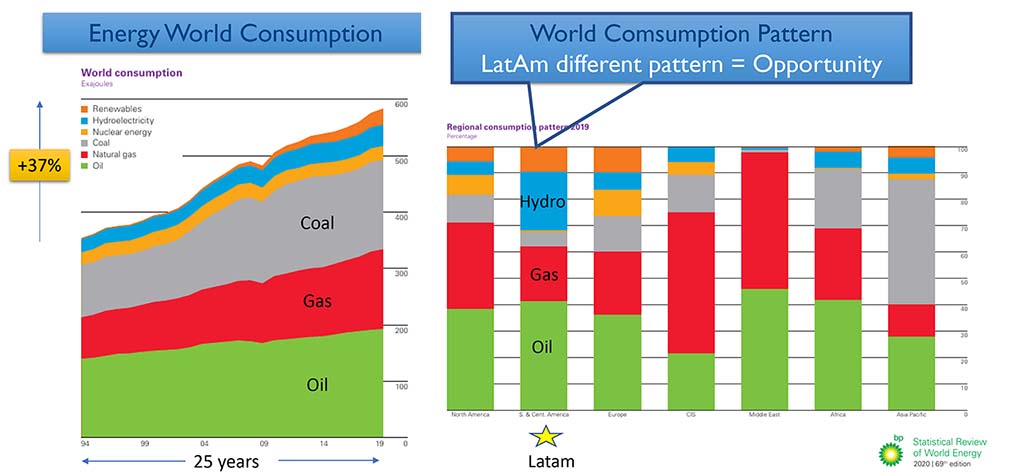

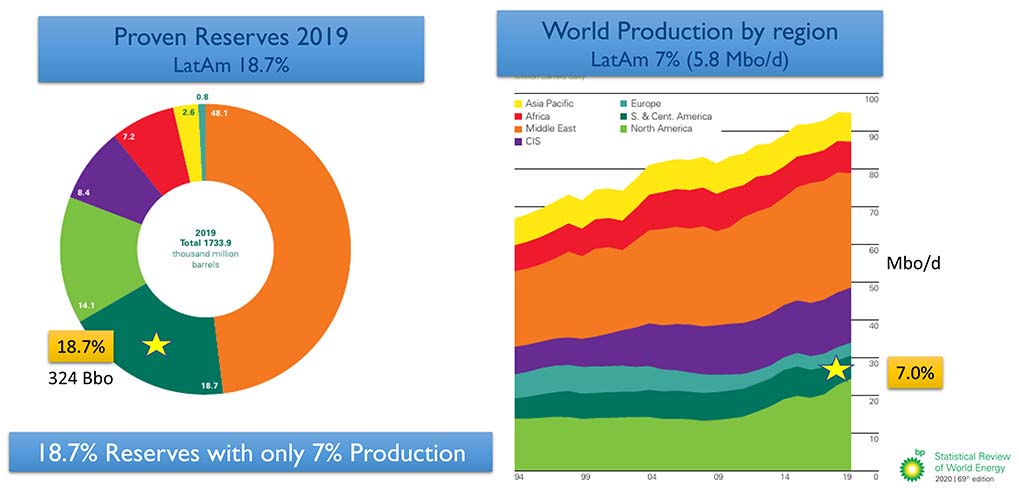

LatAm exploration investments: World picture 2019

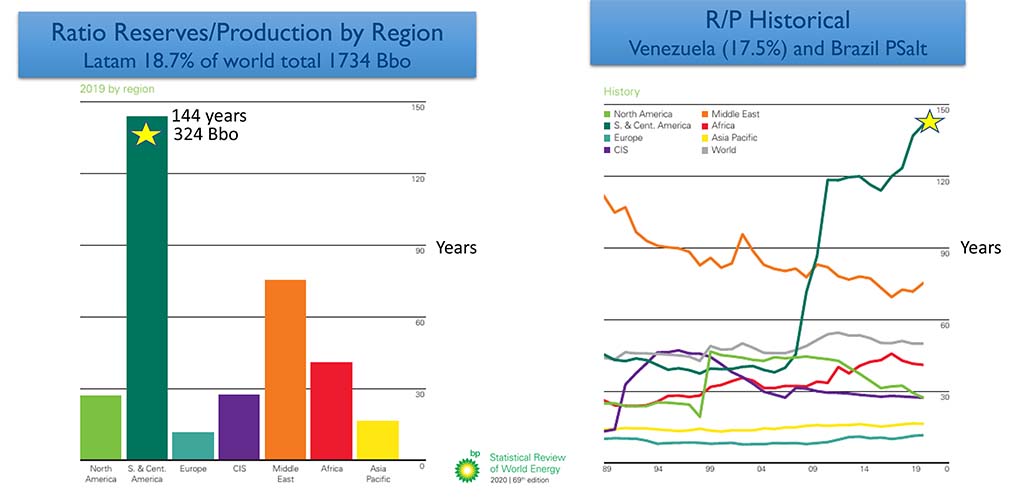

LatAm exploration investments: Why LatAm ? Oil story

LatAm exploration investments: Why LatAm ? Oil story

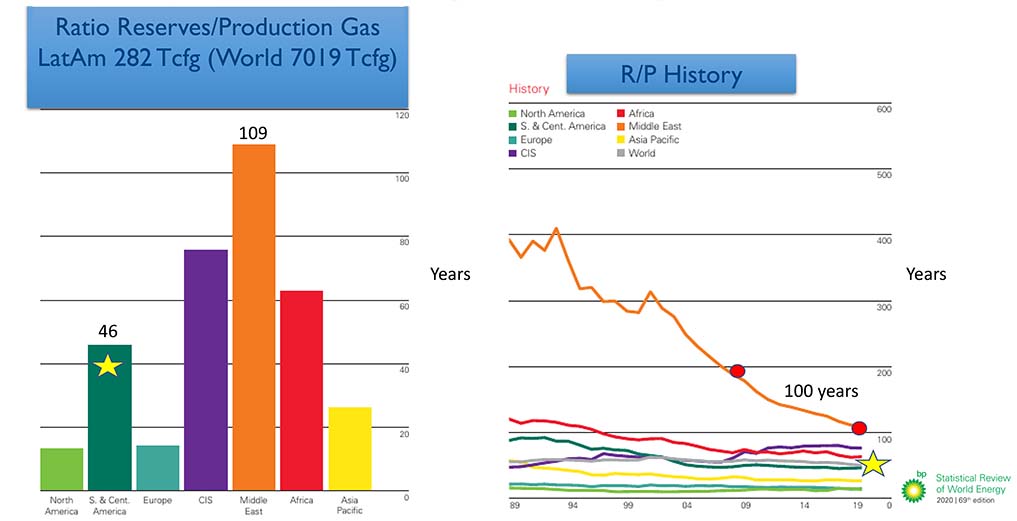

LatAm exploration investments: Why LatAm ? Gas story

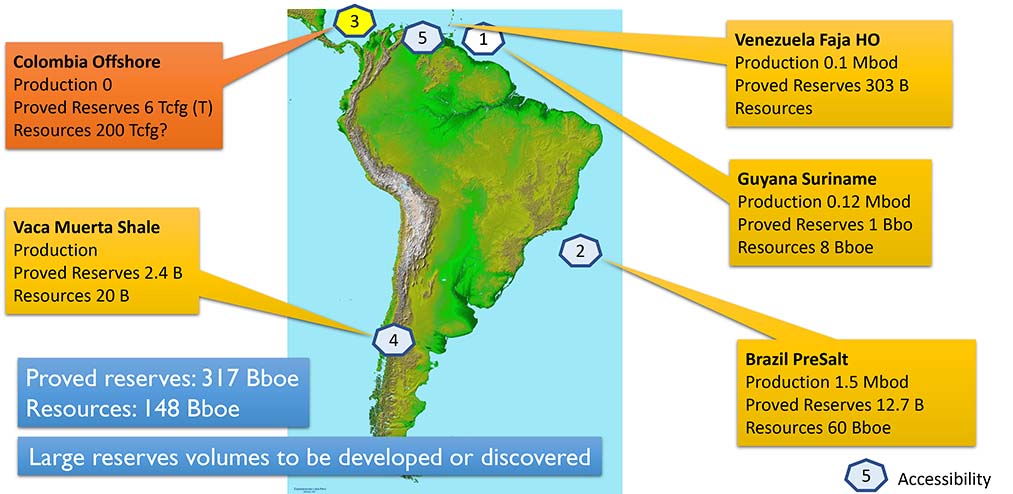

LatAm exploration: World class E&P plays in LatAm

LatAm exploration investments: Conclusions (I)

- Largest R/P ratio (144 years) showing large undeveloped reserves volumes (Oil reserves proven 324 Bbo vs 1734 Bbo world)

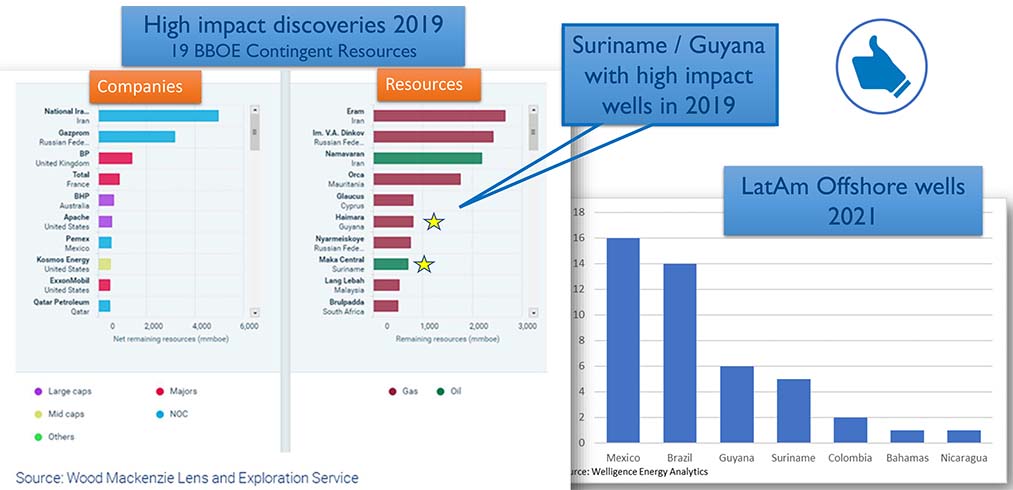

- Large untapped resources opportunity (Venezuela, Brazil, Argentina, Guyana and Colombia)

- Gas consumption share much lower than world. Opportunity to develop gas markets

- LatAm offers potentially large gas resources in new gas plays (Offshore Colombia, Venezuela ..)

- Unique resource and market conditions to develop a significant position if region places right terms and use them intelligently in the next cycle

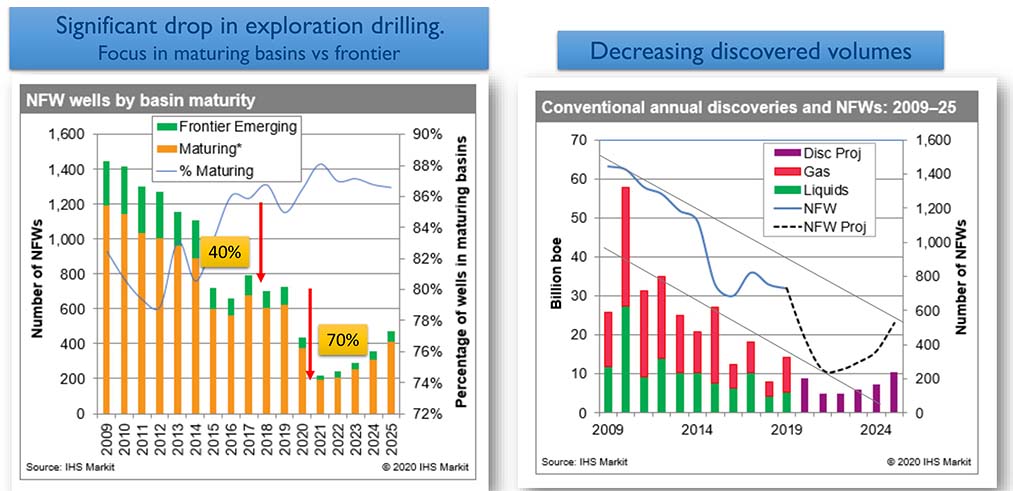

LatAm exploration investments: Exploration activity (I)

LatAm exploration investments: Exploration activity (II)

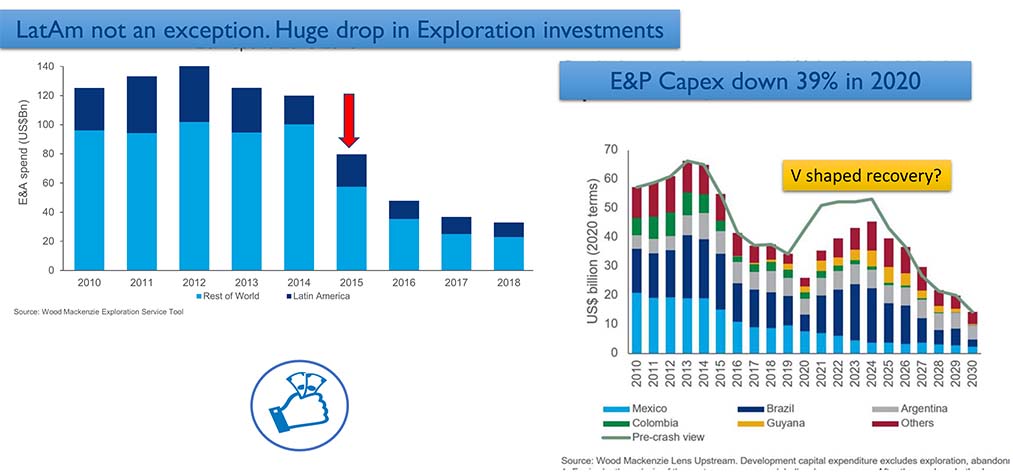

LatAm exploration investments: Capex cuts 2010 – 2020

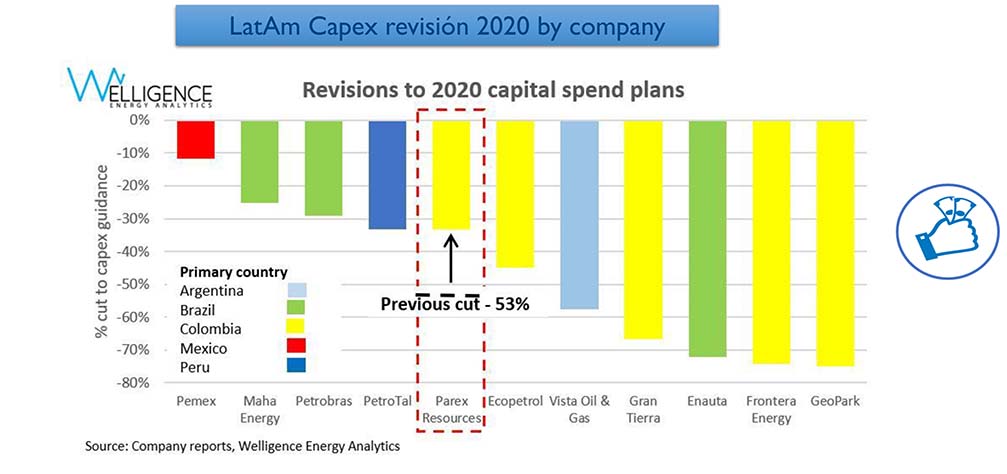

LatAm exploration investments: Capex 2020 by company

LatAm exploration activity: High impact wells 2019

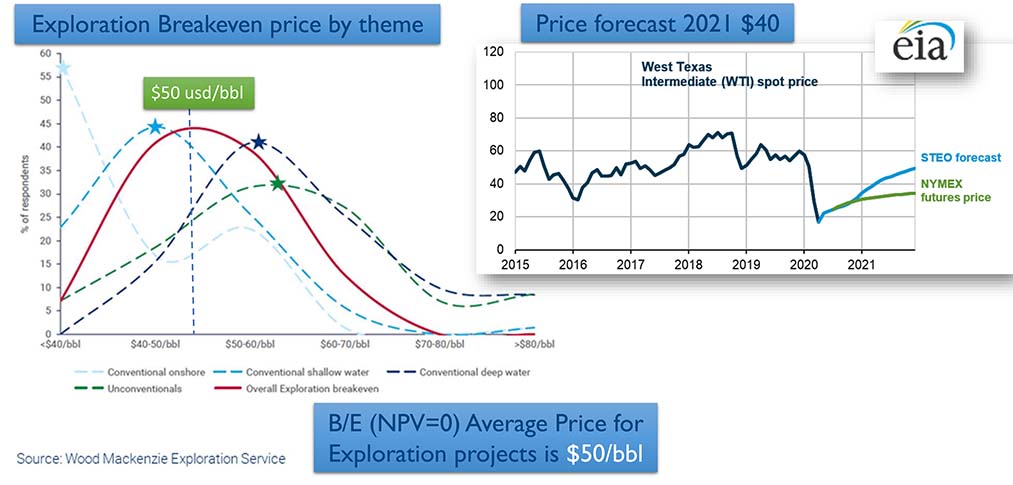

LatAm exploration investments: Price and breakevens

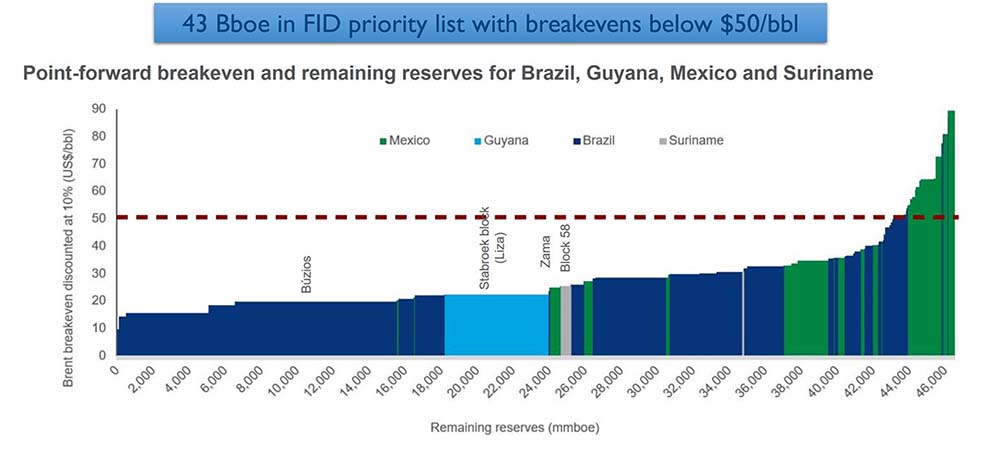

LatAm exploration investments: Offshore projects breakevens

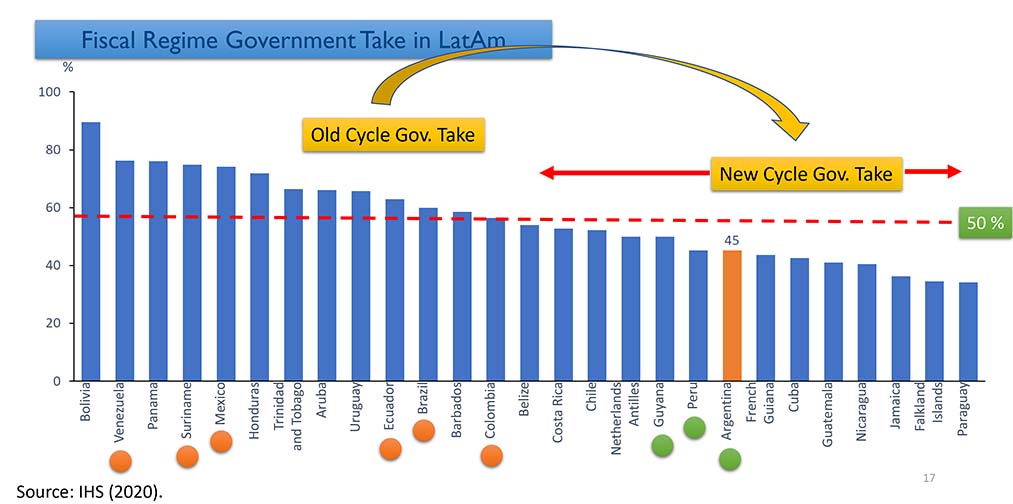

LatAm exploration investments: Regional Government take

LatAm exploration investment: Conclusions (II)

- Industry perception that existing resources are enough to satisfy future demand. Possibly not a correct assumption

- Investments in exploration dropped from 45% to 5% as % of EP in 20 years. NFW wells from 1400 to less that 200 in 10 years

- Resources discovered volumes dropped from 30 to 5 BBO/year

- World average Breakeven prices for Exploration Portfolios are near $50/ bbl

- LatAm has large offshore projects (43 Bboe ) with B/E below $50

- LatAm needs to restructure Government Takes to below 50% to attract the next wave of investments

With large untapped resources and undeveloped markets, LatAm could become a major player in next cycle New favorable Gov Takes and political stability are key to the success of the region.