See the full presentation in PDF

Stuck with expensive oil after “Peak Demand”? Or no worries?

LATAM & CARIBBEAN

OIL, GAS & ENERGY SUMMIT

Technical Practices

- Exploration

- Drilling, Development, Production, IOR, EOR

- Renewable Energy and Environmental-Social-Governance

- Data Analytics to Production

Commercial Practices

- Strategy and Portfolio

- Making Quality Entry and Investment Decisions in the Americas

- M&A&D Consulting to Companies, Private Equity and support to Banks, Law Firms and Accountancies

- Government Agencies and National Oil Companies

Inhouse Tailored Training

- Short Courses and Troubleshooting Workshops

WhyPlata Energy?

- Plata Energy is an Upstream O&G consulting company primarily focused on LatAm. Our team is comprised of seasoned geoscientists, engineers, energy economists, data scientists, political scientists and management consultants, bilingual and with advanced degrees. Present in Calgary, Houston, México, Bogotá, Rio de Janeiro, Buenos Aires and Madrid, we offer a unique blend of skills, international and corporate experiences

- Our integrated technical and commercial practices cover geosciences, exploration, conventional, unconventional and offshore field development, operations, IOR, optimization, supply chain, M&A and surface risks, linking science and technology with management and finance, to offer tailored solutions

- We connect investors to opportunities, and beyond supporting M&A technical/operational/commercial/regulatory due diligence, we assist in post-merger integration strategy, reorganization and portfolio realignment

Plata Energy, the Americas O&G specialists and the one-stop-shop for your upstream consulting needs

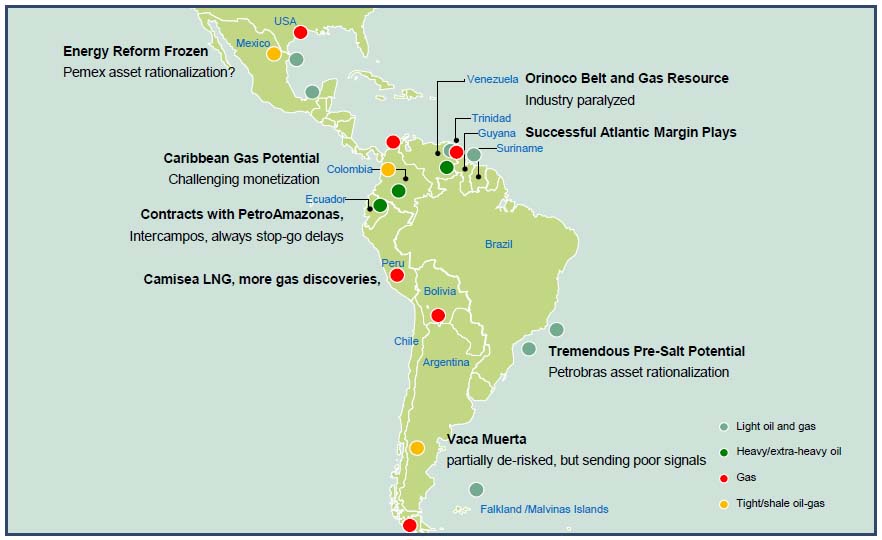

LatAm´s Resorce Potential

Significant Hydrocarbon Potential in a variety of Basins/Plays

Source: Plata Energy

North Cone Trends

Guyana-Suriname Boom, Mexico wasthe New Star, when Venezuela?

Source: Wood Mac, Plata Energy

South Cone Trends

Pre-Salt and VacaMuerta, the big Resource Plays

Source: Wood Mac, Plata Energy

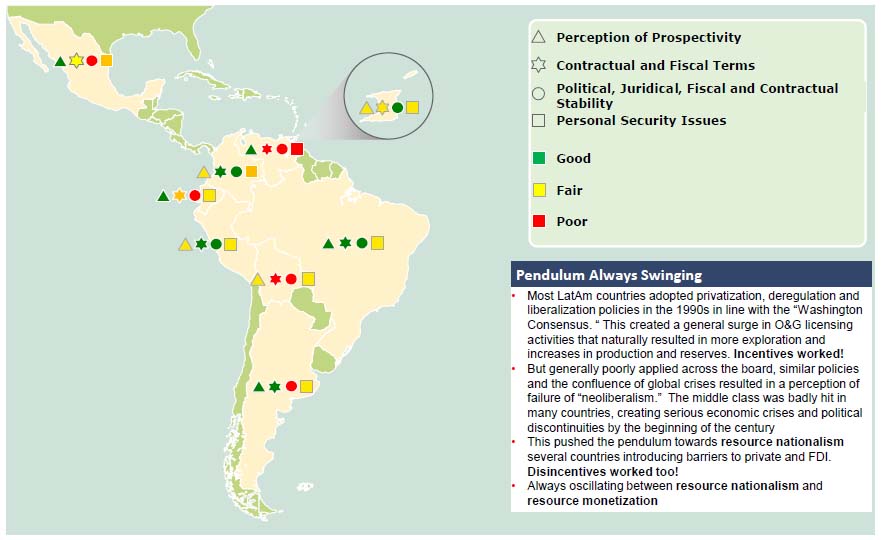

Perfection in LatAm?

Source: Plata Energy

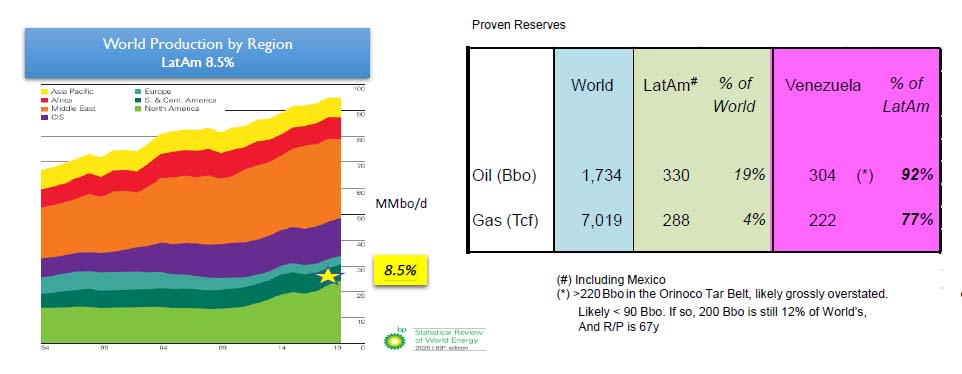

Comparative Production and Reserves

Disproportionate Reserves/Production, even with overstated Venezuela

Source: BP’s Statistical Review

- World oil production 95.1 MMbo/d: 50y

- LatAmoil production 8.1 MMbo/d: 111y

- Unproven oil 126 Bbo

- Unproven gas 679 Tcf

- LatAm’s onshore reserves dominated by heavy an ultra-heavy oil

- What would happen if Energy Transition happens?

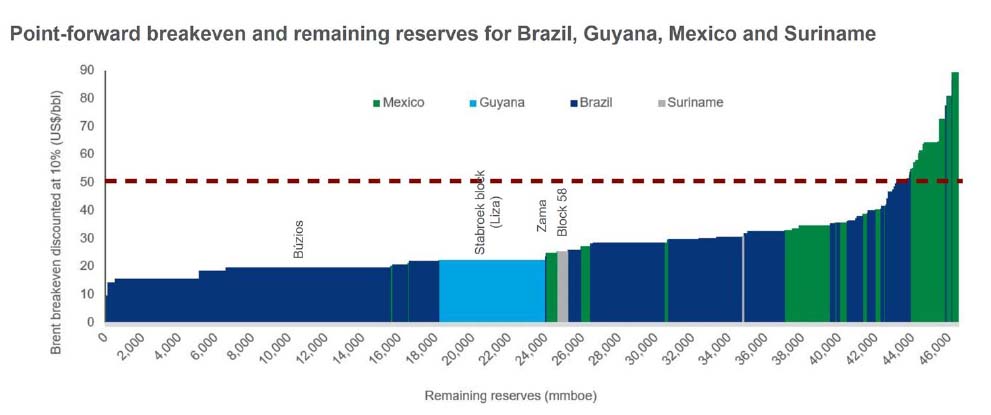

LatAm Offshore Oil is Still Mostly Commercial

43 Bboe in FID priority list with breakeven< $50/bo

Source: Wodd Mackenzie LENS

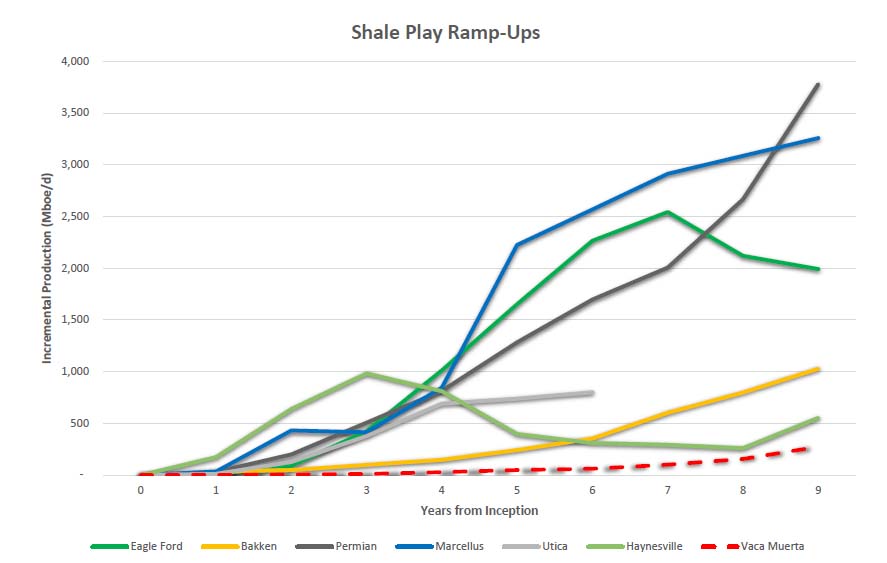

Best LatAm Unconventional is Growing Too Slowly

Vaca Muerta ain’t in Texas

Source: Plata Energy

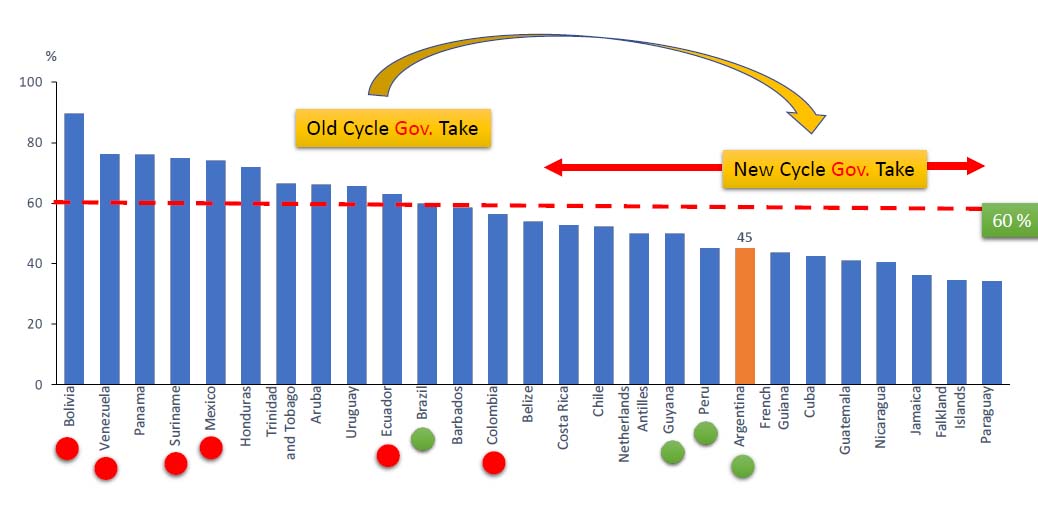

Government Take not too Welcoming

Bolivia, Venezuela, Suriname, México, Ecuador & Colombia should reconsider

Argentina should offer more macro and O&G framework stability

Source: IHS (2020)

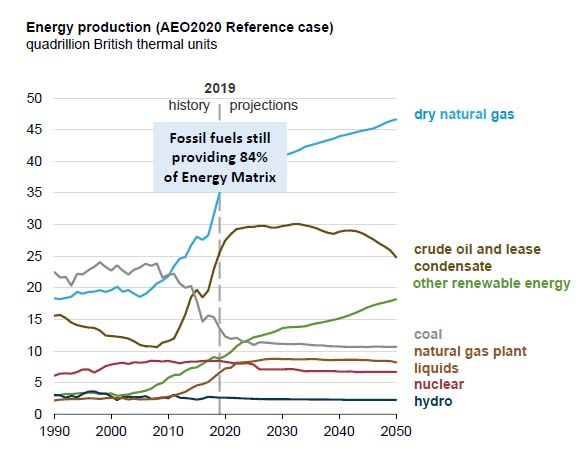

New Energy Economy?

Faster than we thought? Or still “magical thinking”?

Source: EIA (2020)

- Our gas should be the transition fuel

- Solar and Wind could provide 30% of all generation (80% of growth) by 3030 diversify supply technologically and geographically, many more actors, less geopolitics, less volatility?

- Penetration of solar and wind is making their prices drop. Offshore wind attracting big capital at cagr17% and solar growing at 12%. But what about their physical boundaries?

- Fact: China males 72% of solar modules, 69% of Lithium batteries and 45% of wind turbines, and controls the refining of Cobalt and Lithium. Building electric-car infrastructure…

The Transition to Energy Transition

Not in our hemisphere…yet

- Europe under political pressure to transition. EU wants to cut greenhouse gas emissions by 55% from 1990 levels in the next decade. Germany 80% renewable power by 2050

- Renewables’ surplus could feed Greenhydrogen, a balancing-peak shaving tool. Huge push for Green Hydrogen in Australia and Europe (circa 60 GW in project pipeline). Negligible in the Americas (1 GW)

- Unilever removing petrochemicals from its home cleaning products by 2030 (not just an internal combustion issue, a petrochemicals issue too?…)

- Shell, Repsol, Equinor, BP: net-carbon neutral by CCS (carbon capture and storage): Capture CO2, use in EOR, embed in concrete and in polyurethanes

- Are shareholders ready to commit? BP’s stock sunk to a 25-year low after publication of its Net Zero Target. Vision, or premature enthusiasm?

- Reality doesn’t really matter; perception matters

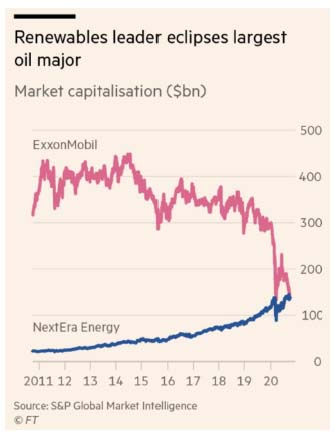

Clean-Energy Industry Picking Momentum

Will CCS save us, or is Oil & Gas going out of fashion?

- No such pressure in the Americas (Chevron, ExxonMobil, Latin NOCs)…yet.

- However, Biden wants to spend 2 tr$ decarbonizing America…

- Clean power stocks up 45% by mid Sep

- Exxon Mobil out of DOW (joined in 1928). Next Era catches-up with ExxonMobil.

- Shale Revolution losing its luster?

- Oil stocks: damned if you do (BP), damned if you don’t (XOM)?

Peak Oil is now about Peak Demand

LatAm’s procrastination stocked now unmonetizable resources?

- Solar, Wind and Batteries have robust physical limits, but what if a new disruptive technologies emerge?

- LatAmwould be slow into the Energy Transition because they have too much hydrocarbon to burn. But what if it happens? What about export surpluses? What about prices? Will the State or the Consumers subsidize our industry?

- Heavy oil, expensive unconventional oil, running out of fashion?

- Venezuela in chaos. Argentina and Ecuador dragged their feet. México had a good thing going-on, and elected to just shoot itself in the foot

- The cruise ship is leaving, and they are still at home packing the ski gear? Or is there’s really nothing to worry about?

Wake-up Call? Or is it Alarmist Hype?

Should LatAm governments gamble with their resources?

“The Stone Age didn’t end for lack of stone, and the Oil Age will end long before the world runs out of oil”

These words have been credited to Ahmed Zaki Yamani, former Minister of Oil of Saudi Arabia.

Perhaps petroleum-rich countries in LatAm should hedge their bets and start thinking about that.